Rolex and Patek Philippe Prices Have They Finally Stabilised?

For nearly two years the luxury watch market has been in a state of correction following the unprecedented highs of 2021 and early 2022. Rolex, Patek Philippe and Audemars Piguet saw soaring secondary market prices during that period driven by heightened demand and speculative investment. However since mid 2022 prices have been adjusting downward.

Recent data from WatchCharts.com suggests that prices may have finally found a floor, particularly for Rolex and Patek Philippe after a period of consistent decline.

At Kettle Club we closely monitor the pre owned watch market, helping collectors and investors navigate changing trends. Here is what the latest data reveals about current market conditions and where prices could be headed next.

Are Watch Market Prices Starting to Stabilise?

According to WatchCharts.com the Overall Market Index fell by just 0.2% in February 2025 which is one of the smallest declines in recent months. This suggests the downward trend is slowing and in some cases reversing.

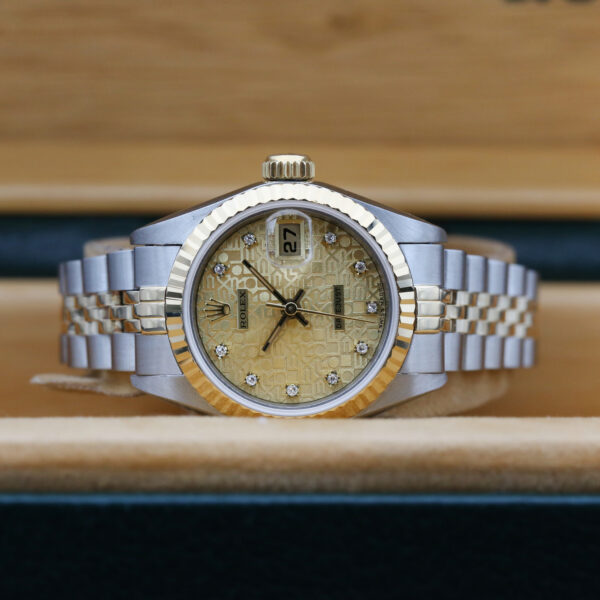

Rolex Prices Show First Signs of Recovery

For the first time since September 2024 Rolex prices saw an increase rising by 0.2% in February 2025. It is a small shift but an important one that suggests demand for key models is holding firm.

Why is Rolex Leading the Market Recovery?

A History of Market Resilience

Rolex has always maintained some of the strongest resale values in the luxury watch market, which has consistently outperformed most other brands.

Supply and Demand Control

Unlike brands that flood the market Rolex carefully controls supply which keeps demand and resale values strong.

The Watches & Wonders Effect

Every year in the lead up to Watches & Wonders Rolex prices tend to increase as collectors anticipate new releases or potential discontinuations.

WatchCharts.com reports that this pattern has been evident in past years including March 2023 and March 2024 when pre owned Rolex prices saw a temporary boost ahead of new model announcements.

How Are Patek Philippe and Audemars Piguet Performing?

Patek Philippe prices dropped by 0.8% in February and are down 6.5% year over year according to WatchCharts.com. Meanwhile Audemars Piguet remained stable with no movement in February. This could indicate that prices for AP watches have reached their lowest point and may be on the verge of stabilising.

The decline in Patek Philippe’s prices is relatively minor compared to previous months which suggests that the market is adjusting rather than continuing a steep downward trajectory. Some models particularly in the Calatrava and Grand Complication lines are still correcting after the speculative price surge of 2021 and 2022. However core sports models such as the Nautilus and Aquanaut continue to command strong demand which is keeping overall prices from dropping too aggressively.

Patek Philippe Cubitus Release and Market Impact

A significant factor influencing Patek Philippe’s market performance is the October 17 2024 release of the Cubitus collection. As with most new luxury timepieces resale prices surged initially due to strong demand with early buyers willing to pay a premium to secure the watch before wider availability. However as more pieces enter the market resale values are expected to stabilise and find their equilibrium.

This trend has been observed across many high profile Patek Philippe releases such as the Nautilus 5711 Tiffany Blue which saw an immediate spike in secondary market pricing before gradually settling. Similarly when the Patek Philippe 5811 1G Nautilus replaced the 5711 early resale prices were inflated but as availability increased prices began to correct.

How Will Patek Philippe Prices Perform Moving Forward?

Continued Strength in Sports Models

The Nautilus and Aquanaut remain Patek Philippe’s most desirable collections with resale values holding steady despite broader market corrections. These watches consistently perform well due to their limited production and enduring demand among collectors and investors.

Correction in Grand Complications

Some of Patek’s more intricate models particularly those with minute repeaters perpetual calendars and tourbillons have seen slower resale movements. The market for ultra high end watches has softened slightly as speculative buyers shift toward more liquid assets.

Market Finding Its Floor

While the 6.5% year over year decline is notable the fact that the rate of decrease is slowing suggests that prices are close to stabilising. Historically Patek Philippe watches have retained their value well and once the market correction runs its course values may begin to appreciate again.

For collectors and investors this represents an opportunity to acquire undervalued Patek Philippe references before prices level off or start climbing again. At Kettle Club we continue to monitor these trends closely ensuring that our clients stay informed and well positioned in the market.

Which Watches Are Holding Their Value?

Not all watches are experiencing the same trends. Some collections are gaining value while others continue to decline.

Best Performing Watch Collections in February 2025 (Source WatchCharts.com)

Rolex Air King 1.0% Increase

The modern 126900 reference is still in demand with collectors drawn to its updated design and improved movement.

Rolex Daytona 0.8% Increase

One of Rolex’s most sought after collections continues to perform well.

Omega Seamaster 0.7% Increase

The Seamaster line especially the 300M and Ultra Deep models has seen renewed collector interest.

Watches That Lost Value

Breguet Tradition 2.3% Decrease

A highly respected name but secondary market value has struggled in recent years.

TAG Heuer Carrera 2.5% Decrease

The market correction continues especially for quartz and entry level automatic models.

Cartier Ballon Bleu 3.0% Decrease

The Tank and Santos collections are holding up well but demand for the Ballon Bleu has dropped.

This data reinforces that sports watches remain the safest investment with Rolex Omega and select AP models continuing to attract buyers.

What is Behind the Market Stabilisation?

According to WatchCharts.com several key factors are influencing the shift in market conditions.

Economic Conditions and Market Adjustment

The luxury watch boom of 2021 and 2022 was fuelled by low interest rates and an influx of speculative buyers which pushed prices well above retail. As financial conditions tightened in 2023 and 2024 the market corrected.

Now the worst of the correction appears to be over and the watch market is returning to a more sustainable level.

Rolex’s Strategic Production Management

Unlike some brands that overproduce Rolex carefully regulates supply which prevents over saturation and helps watches hold their value.

Models like the Submariner Daytona and GMT Master II continue to be produced in limited quantities which keeps demand high.

Even discontinued models like the Hulk Submariner 116610LV and the Batman GMT Master II 116710BLNR continue to command strong resale prices due to their scarcity.

The Build Up to Watches & Wonders 2025

As Watches & Wonders 2025 approaches speculation is already affecting pre owned Rolex prices.

Collectors are watching closely to see if

The Rolex GMT Master II Pepsi will be discontinued

If so expect prices to climb significantly.

A Platinum GMT Master II 70th Anniversary Edition could be announced

This would become an instant grail watch for collectors.

Patek Philippe will introduce new stone dial models

Given their recent market performance Patek may use this strategy to reignite demand.

What Does This Mean for Collectors and Investors?

With the market showing signs of stabilisation this could be the right time to make strategic watch investments.

Rolex remains the safest choice

Models like the Submariner Daytona and GMT Master II are likely to retain strong value.

Patek Philippe could present buying opportunities

With prices still adjusting now may be the best chance to pick up an undervalued reference before the market rebounds.

Focus on timeless highly sought after models

Collectors should prioritise watches with proven resale performance such as steel sports models rare references and discontinued pieces.

Final Thoughts Is Now the Right Time to Buy?

The latest data from WatchCharts.com suggests that the market is stabilising with Rolex showing the first signs of a recovery.

For collectors this could be one of the best opportunities to acquire key references before prices start rising again.

Interested in adding an investment worthy watch to your collection Get in touch with our team or browse our latest stock today.